OUR PARTNERSHIP WITH LV= GENERAL INSURANCE

How LV= General Insurance Became Digital‑First

Transforming one of the UK’s Insurance Leaders from the Top Down

Co-created a transformation strategy, three-year roadmap & business case

Conducted a 13-week customer research program

Developed a content strategy

Defined the future web architecture on Microsoft Azure

Evolved the brand, including visual identity, design language & tone of voice

Launched a refreshed LV.com on Sitecore

Won Best Transformation & Consultancy at BIMA Awards

Developed proposition for new insurance product

Launched data & personalization strategy to drive greater value for the customer

Supported ongoing transformation through managed services

Making Transformation Real for LV=

LV= General Insurance’s Digital Transformation Director came to EPAM Continuum with a dream brief: Create a fundamental mind-shift to digital within the organization – from the board level down – in order to augment its offline, award-winning customer experience, as well as the business itself.

We embarked on a 16-week journey with LV= General Insurance’s board and senior team that reshaped their views and beliefs. From there, a three-year transformation strategy, roadmap and business case were born, delivering a significant step-change across the insurance business.

Following the success of our consulting engagement, we were asked to make this strategy real. We designed and built a new platform for LV= General Insurance’s personalized digital products and services, which included a reimagined LV.com that resulted in a 30% increase in online quotes and was delivered in just nine months.

CONSULTING HIGHLIGHTS

10

LV= Board Members that we Explored the Future with

80+

LV= Stakeholders Consulted & Co-created with

16

Weeks of Cross-Departmental Workshops

13

Weeks of Qualitative Customer Research

Winner

Awarded Best Transformation & Consultancy by BIMA

“A core part of our strategy was to ‘Go Digital’, to engage with our customers, employees and business partners in new ways and to think differently about how we conduct business and organize ourselves. EPAM Continuum took us on a journey that resulted in a fully funded three-year transformation strategy, roadmap and set of capabilities that has allowed us to deliver a significant step-change at LV= General Insurance. Their high energy, collaborative approach to consulting empowered us to envision a digitally-powered transformation that touches every part of the business.”

Heather Smith

Managing Director, LV= General Insurance

Making Transformation Real for LV=

LV= General Insurance’s Digital Transformation Director came to EPAM Continuum with a dream brief: Create a fundamental mind-shift to digital within the organization – from the board level down – in order to augment its offline, award-winning customer experience, as well as the business itself.

We embarked on a 16-week journey with LV= General Insurance’s board and senior team that reshaped their views and beliefs. From there, a three-year transformation strategy, roadmap and business case were born, delivering a significant step-change across the insurance business.

Following the success of our consulting engagement, we were asked to make this strategy real. We designed and built a new platform for LV= General Insurance’s personalized digital products and services, which included a reimagined LV.com that resulted in a 30% increase in online quotes and was delivered in just nine months.

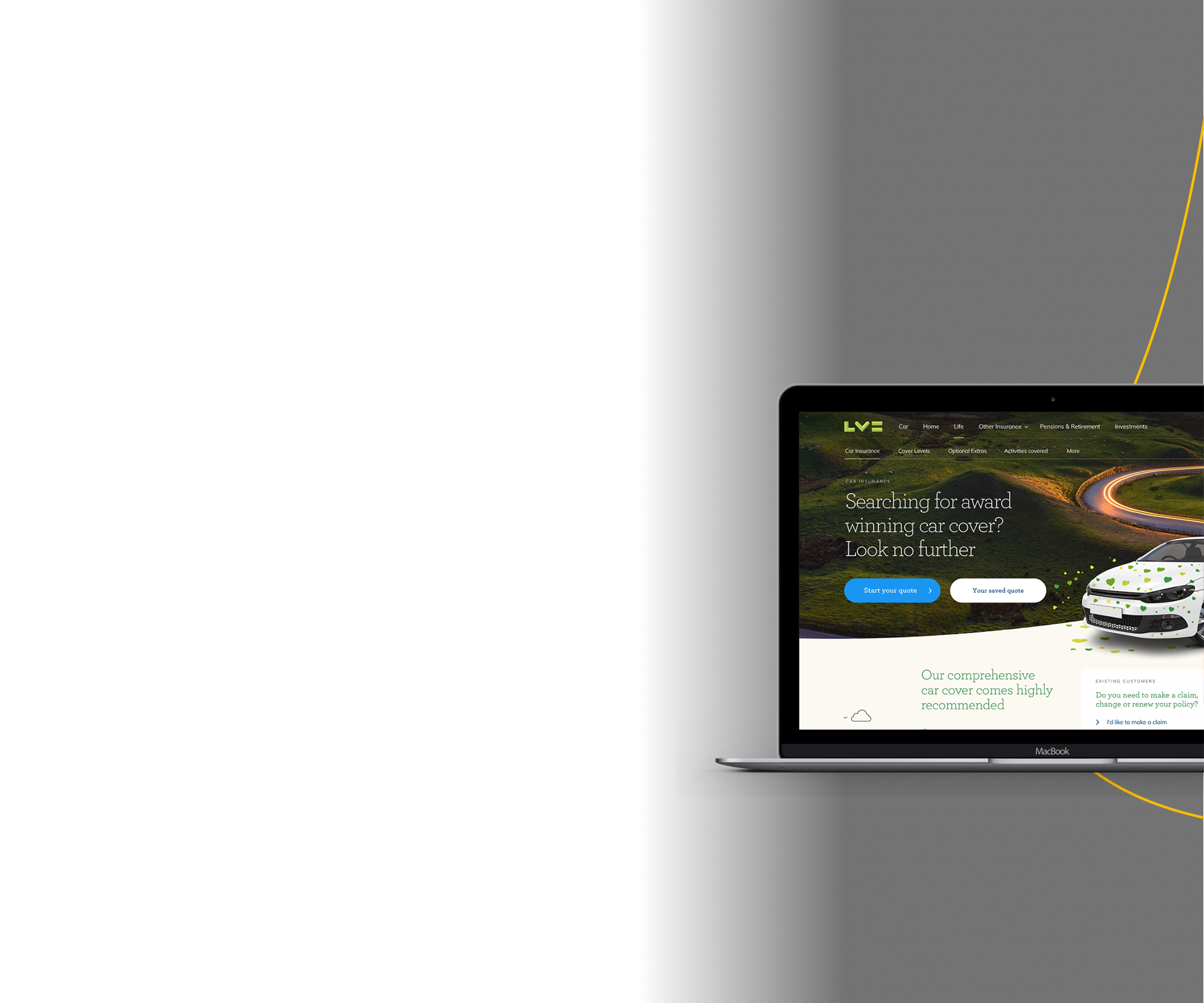

We Evolved Britain’s Best Loved Insurance Brand

EPAM Continuum adapted the visual identity, design language and tone of voice for digital, moving LV= General Insurance from an endearing brand to one that all customers feel connected to.

We worked closely with senior stakeholders across the business to create alignment and define the future of the brand by:

Setting an ambition that created alignment and guided our design exploration

Reviewing the market, mapping principles and conducting tone of voice workshops

Creating a manifesto, based on the brand proposition, that helped set a clear direction and motivation for all future considerations

Establishing three fresh and differentiated brand concepts that reflected the proposition, principles and behaviors, which were then tested with existing and potential LV= customers

Developing the design system and refreshed tone of voice to serve as a guide for the future and ensure a seamless transition of knowledge and assets with LV=’s design team

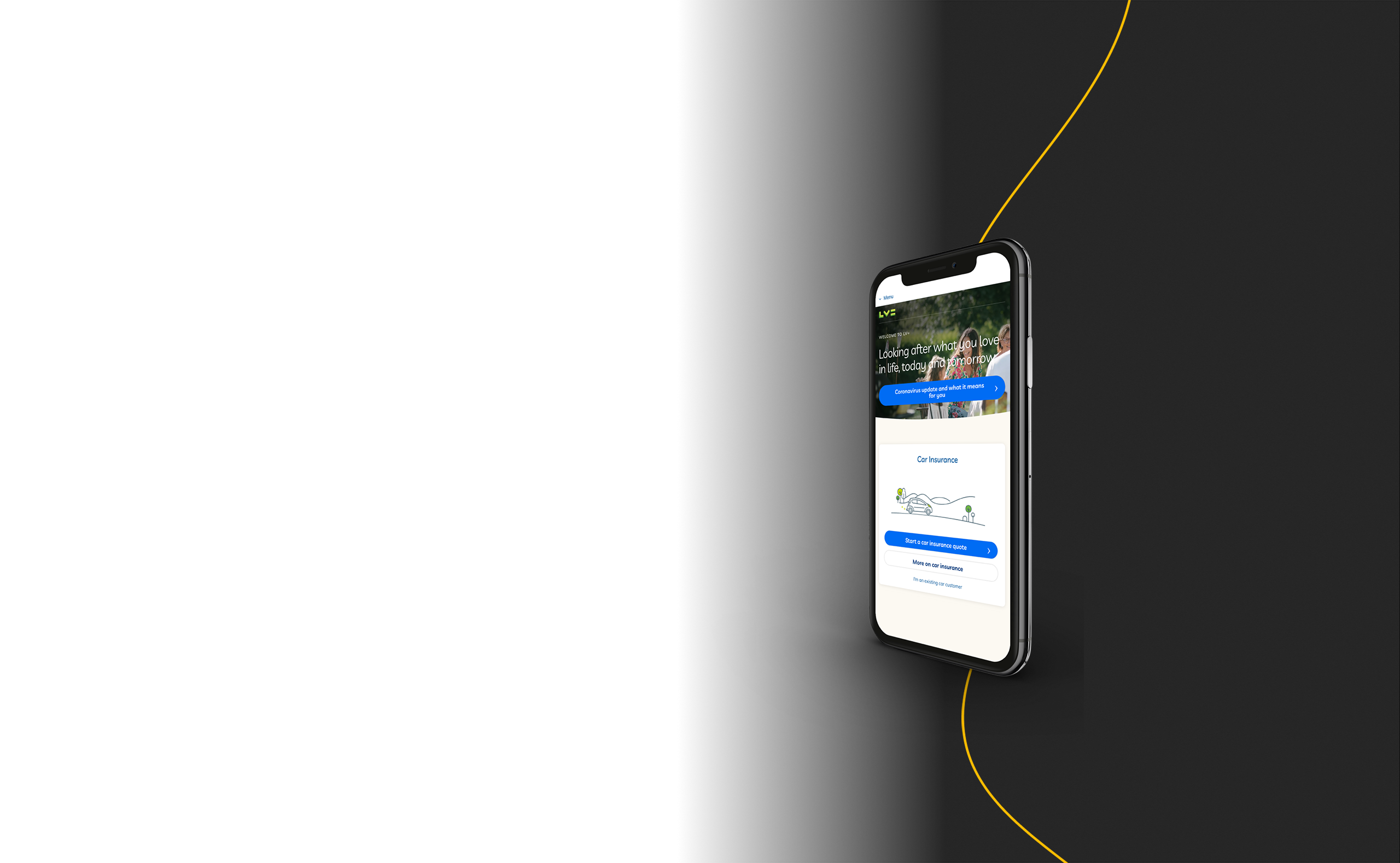

Together, We Reimagined LV= General Insurance’s Digital Experience

Our transformational work included:

- Improving the complicated, impersonal experience of buying insurance by delivering a mobile-first, light-tough, guided approach that makes it easier than ever before for customers to find what they need

- Transforming the content strategy by building a strategic framework with editorial themes and topics for better team alignment

- Delivering a data and personalization strategy and framework that identified 70+ opportunities for personalization to drive greater value across the customer journey

- Developing a powerful platform on Microsoft Azure and Sitecore that enables LV= to redefine its entire digital experience, as well as quickly and efficiently create and publish content

- Creating a scalable architecture and supporting infrastructure that is compliant in a highly regulated environment

- Establishing a managed services partnership to maintain platform stability and help unlock potential through continuous enhancements

We Created New,

Differentiated Propositions

As part of the transformation roadmap, we helped LV= General Insurance develop innovative propositions, including a new digital-only insurance product that was validated by both the business and its customers.

We began by assessing the competitive environment and the maturity of similar products that were live or in testing. We worked with LV= General Insurance to evaluate the potential market and shape qualitative research into core customer needs and value-drivers.

Building on this research, we created a 12-point custom framework to define and assess the new proposition. Working with multiple stakeholders across the insurance and digital product fields, we established the product features and assessed them against customer demand, business capability to deliver and potential value.

We defined three versions of the proposition, ranging from MVP to future state, as well as a product manifesto and design to bring the brand to life and generate excitement from stakeholders.

CONSULTING HIGHLIGHTS

Together, we created a new era of cross-functional collaboration in the business.

Our multi-layered transformation helped LV= General Insurance grow from the eleventh to the third largest personal lines insurer in the UK. We achieved the following results:

38%

Increase in car insurance start quote rate

31%

Increase in mobile conversion

30%

Increase in online quotes

25%

Increase in home insurance start quote rate

12%

Growth in mobile revenue

7x

Improved page load speed

TECH STACK

CONTACT US

Hi! We’d love to hear from you.

Are you ready to design the business models of tomorrow?